Jennifer Sloan Wells Fargo Center for the Arts Bankruptcy

Company logo since 2019 | |

Wells Fargo's corporate headquarters complex in San Francisco, California | |

| Type | Public |

|---|---|

| Traded as |

|

| ISIN | US9497461015 |

| Industry |

|

| Predecessors |

|

| Founded | 1929 (1929) in Minneapolis, U.S. (as Northwest Bancorporation) 1983 (as Norwest Corporation) 1998 (every bit Wells Fargo & Company) |

| Founders |

|

| Headquarters | San Francisco, California, U.S. (corporate); New York, NY (operational)[one] |

| Number of locations |

|

| Surface area served | Worldwide |

| Key people | Steven Black (Chairman) Charles Scharf (President and CEO) |

| Products | Asset management, banking, bolt, credit cards, equities trading, insurance, investment management, mortgage loans, common funds, private equity, risk management, wealth direction |

| Revenue | |

| Operating income | |

| Net income | |

| Total assets | |

| Full equity | |

| Number of employees | 268,531 (2020) |

| Subsidiaries |

|

| Website | wellsfargo.com |

| Footnotes / references [3] | |

American Express Co. early receipts (1853, 1869)

Stagecoach with Christmas gifts Wells Fargo Bank San Francisco

Wells Fargo & Co. Limited building circa 1860, Stockton, California

Wells Fargo & Co. $two postage stamp and 10 cents stamped envelope with Pony Express cancellation, carried from San Francisco to New York Urban center in 12 days, during June 1861.

Wells Fargo & Visitor is an American multinational financial services company with corporate headquarters in San Francisco, California, operational headquarters in Manhattan,[iv] and managerial offices throughout the United States and internationally.[3] The company has operations in 35 countries with over seventy million customers globally.[iii] It is considered a systemically of import fiscal institution by the Financial Stability Board.

The firm'south primary subsidiary is Wells Fargo Depository financial institution, N.A., a national banking company chartered in Wilmington, Delaware,[3] which designates its chief part in Sioux Falls, South Dakota. It is the fourth largest banking company in the U.s. by full assets and is one of the largest equally ranked by bank deposits and market capitalization. Along with JPMorgan Hunt, Bank of America, and Citigroup, Wells Fargo is ane of the "Big Four Banks" of the United States.[5] It has 8,050 branches and xiii,000 ATMs.[iii] Information technology is one of the most valuable depository financial institution brands.[half-dozen] [7]

Wells Fargo in its present course is a result of a merger between the original Wells Fargo & Company and Minneapolis-based Norwest Corporation in 1998. While Norwest was the nominal survivor, the merged company took the better-known Wells Fargo name and moved to Wells Fargo'due south hub in San Francisco, while its banking subsidiary merged with Wells Fargo's Sioux Falls-based banking subsidiary. With the 2008 acquisition of Charlotte-based Wachovia, Wells Fargo became a declension-to-coast banking company. Wells Fargo is ranked 37th on the Fortune 500 list of the largest companies in the US.[iii] [eight] The visitor has been the subject of several investigations by regulators; on February 2, 2018, business relationship fraud past the bank resulted in the Federal Reserve disallowment Wells Fargo from growing its nearly $2 trillion-nugget base whatsoever further until the company fixed its internal problems to the satisfaction of the Federal Reserve.[ix] In September 2021, Wells Fargo incurred further fines from the United states Justice Department charging fraudulent behavior past the banking concern confronting strange-exchange currency trading customers.[x] Bloomberg Businessweek reported in March 2022 that Wells Fargo was the but major lender in 2020 to pass up more domicile refinancing applications from Black applicants than it approved.[xi]

History [edit]

Company Logo from 1996 until 2019

A late 19th century Wells Fargo Bank in Apache Junction, Arizona

1879 Wells Fargo stagecoach

Henry Wells and William Grand. Fargo, who had helped constitute American Express along with John Butterfield, formed Wells Fargo & Company in 1852 to provide "express" and cyberbanking services to California, which was growing rapidly due to the California Gold Blitz. Its earliest and nearly significant tasks included transporting gold from the Philadelphia Mint and "express" mail service delivery that was faster and less expensive than U.S. Mail.

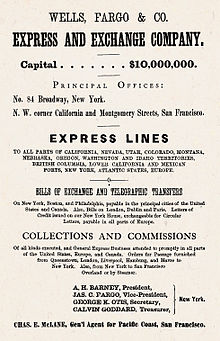

By the finish of the California Gilt Rush, Wells Fargo was a ascendant limited and banking organization in the west, making large shipments of gold and delivering mail and supplies. It was also the primary lender of Overland Mail Company, which ran a 2,757 mile route through the Southwest to San Francisco and was nicknamed the "Butterfield Line" later the company's president John Butterfield.

In March 1860, Wells Fargo gained command of Butterfield Overland Mail Company, after Congress failed to pass the almanac post part appropriation beak, thereby leaving the post role with no manner to pay for the Overland Mail Company's services, and leaving Overland no way to pay Wells Fargo. Wells Fargo and so operated the western portion of the Pony Limited.[12]

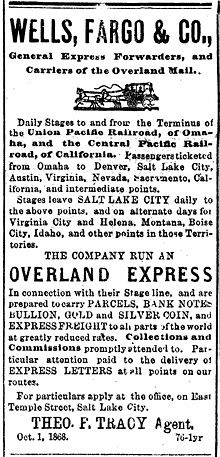

Wells, Fargo & Co. 1868 display advertisement from The Salt Lake Daily Telegraph (Utah Territory)

In 1866, the "Grand consolidation" united Wells Fargo, Holladay, and Overland Mail phase lines nether the Wells Fargo name.[13]

In 1872, Lloyd Tevis, a friend of the Central Pacific "Big Four" and holder of rights to operate an limited service over the Transcontinental Railroad, became president of the company afterwards acquiring a big stake, a position he held until 1892.[fourteen]

In 1892, John J. Valentine, Sr., a longtime Wells Fargo employee, was made president of the company. Valentine died in tardily Dec 1901 and was succeeded as president by Dudley Evans on January 2, 1902.

In 1905, Wells Fargo separated its cyberbanking and express operations, and Wells Fargo's banking company merged with the Nevada National Depository financial institution to form the Wells Fargo Nevada National Depository financial institution.[15]

In 1918, as a wartime measure, the United states of america government nationalized Wells Fargo'south limited franchise into a federal agency known as the Usa Railway Express Agency (REA). The federal government took control of the express company.[16] The bank began rebuilding but with a focus on commercial markets. After the state of war, the REA was privatized and continued service until 1975.

In 1923, Wells Fargo Nevada merged with the Union Trust Company to form the Wells Fargo Bank & Union Trust Company.[17]

In 1929, Northwest Bancorporation was formed every bit a banking association.

The company did well during the Great Depression; during a Depository financial institution Holiday in March 1933, the company actually gained $two million of deposits.[xviii]

In 1954, Wells Fargo & Union Trust shortened its proper name to Wells Fargo Bank.

In 1960, Wells Fargo merged with American Trust Visitor to course the Wells Fargo Bank American Trust Company.[19]

In 1962, Wells Fargo American Trust shortened its name to Wells Fargo Banking concern.

In 1968, Wells Fargo was converted to a federal banking lease, becoming Wells Fargo Bank, N.A. Wells Fargo merges with Henry Trione'south Sonoma Mortgage in a $ten.viii 1000000 stock transfer, making Trione the largest shareholder in Wells Fargo until Warren Buffett and Walter Annenberg surpassed him.[20]

In 1969, Wells Fargo & Company belongings company was formed, with Wells Fargo Banking concern as its main subsidiary.[21]

In 1982, Northwest Bancorporation caused consumer finance firm Dial Finance, which was renamed Norwest Financial Service the following year.[22]

In 1983, Northwest Bancorporation was renamed Norwest Corporation.

In September 1983, a Wells Fargo armored truck depot in W Hartford, Connecticut was the victim of the White Eagle robbery, involving an insider who worked equally an armored truck baby-sit, in the largest U.s. banking concern theft to date, with $vii.ane million stolen and two co-workers tied up. The robbery was carried out with the support of the government of Cuba and the greenbacks was initially moved to Mexico City.[23] [24]

In 1986, Wells Fargo acquired Crocker National Bank from Midland Bank.[25] [26]

In 1987, Wells Fargo acquired the personal trust business of Banking company of America.[27]

In 1988, Wells Fargo acquired Barclays Depository financial institution of California from Barclays plc.[28]

In 1991, Wells Fargo acquired 130 branches in California from Great American Bank for $491 million.[29]

In May 1995, Wells Fargo became the offset major U.s. financial services firm to offer cyberspace banking.[xxx]

In 1996, Wells Fargo acquired Commencement Interstate Bancorp for $11.6 billion.[31] Integration went poorly as many executives left.[32] [33]

In 1998, Wells Fargo Banking company was caused by Norwest Corporation of Minneapolis, with the combined visitor assuming the Wells Fargo name.[34] [35]

In 2000, Wells Fargo Bank caused National Banking company of Alaska.[36] Information technology also acquired First Security Corporation.

In tardily 2001, Wells Fargo acquired H.D. Vest Fiscal Services for $128 meg, but sold it in 2015 for $580 million.[37]

In June 2007, John Stumpf was named chief executive officer of the company and Richard Kovacevich remained equally chairman.[38]

In 2007, Wells Fargo acquired Greater Bay Bancorp, which had $7.four billion in assets, in a $1.5 billion transaction.[39] [40] [41] [42] Information technology likewise acquired Placer Sierra Bank.[43] It also acquired CIT Grouping'south construction unit of measurement.[44] [45]

In 2008, Wells Fargo acquired United Bancorporation of Wyoming.[46]

In 2008, Wells Fargo acquired Century Bancshares of Texas.[47]

On Oct three, 2008, after Wachovia turned down an inferior offer from Citigroup, Wachovia agreed to be bought past Wells Fargo for about $14.8 billion in stock.[48] On October four, 2008, a New York country estimate issued a temporary injunction blocking the transaction from going forwards while the competing offer from Citigroup was sorted out.[49] Citigroup declared that information technology had an exclusivity understanding with Wachovia that barred Wachovia from negotiating with other potential buyers. The injunction was overturned late in the evening on October five, 2008, by New York state appeals court.[50] Citigroup and Wells Fargo and then entered into negotiations brokered by the FDIC to reach an amicable solution to the impasse. Those negotiations failed. Citigroup was unwilling to take on more adventure than the $42 billion that would have been the cap under the previous FDIC-backed deal (with the FDIC incurring all losses over $42 billion). Citigroup did not cake the merger, only sought damages of $60 billion for breach of an alleged exclusivity agreement with Wachovia.[51]

On Oct 28, 2008, Wells Fargo received $25 billion of funds via the Emergency Economical Stabilization Act in the grade of a preferred stock purchase by the United States Department of the Treasury.[52] [53] As a result of requirements of the government stress tests, the visitor raised $8.6 billion in capital in May 2009.[54] On December 23, 2009, Wells Fargo redeemed $25 billion of preferred stock issued to the United States Department of the Treasury. As function of the redemption of the preferred stock, Wells Fargo as well paid accrued dividends of $131.9 million, bringing the full dividends paid to $1.441 billion since the preferred stock was issued in October 2008.[55]

In April 2009, Wells Fargo acquired North Declension Surety Insurance Services.[56]

In 2011, the company hired 25 investment bankers from Citadel LLC.[57] [58] [59]

In April 2012, Wells Fargo caused Merlin Securities.[60] [61] In December 2012, it was rebranded equally Wells Fargo Prime Services.[62]

In December 2012, Wells Fargo acquired a 35% stake in The Rock Creek Grouping LP. The pale was increased to 65% in 2014 but sold back to direction in July 2018.[63]

In 2015, Wells Fargo Track acquired GE Upper-case letter Rails Services and merged in with Showtime Matrimony Track.[64] In belatedly 2015, Wells Fargo acquired three GE units focused on business loans equipment financing.[65]

In March 2017, Wells Fargo announced a plan to offering smartphone-based transactions with mobile wallets including Wells Fargo Wallet, Android Pay and Samsung Pay.[66]

In June 2018, Wells Fargo sold all 52 of its concrete banking company branch locations in Indiana, Michigan, and Ohio to Flagstar Banking company.[67] [68] [69]

In September 2018, Wells Fargo announced it would cut 26,450 jobs by 2020 to reduce costs by $four billion.[70] [71]

In March 2019, CEO Tim Sloan resigned amidst the Wells Fargo business relationship fraud scandal and onetime general counsel C. Allen Parker became acting CEO.[72]

In July 2019, Chief Financial Group acquired the company'due south Institutional Retirement & Trust business.[73]

On September 27, 2019, Charles Scharf was appear as the business firm's new CEO.[74]

In 2020, the company sold its student loan portfolio.[75] [76]

In May 2021, the company sold its Canadian Direct Equipment Finance business organization to Toronto-Dominion Depository financial institution.[77]

In 2021, the visitor sold its nugget management division, Wells Fargo Asset Management (WFAM) to private equity firms GTCR and Reverence Majuscule Partners for $2.1 billion.[78] WFAM had $603 billion in avails under management as of December 31, 2020,[79] [80] of which 33% was invested in money market place funds.[81] WFAM was rebranded equally Allspring Global Investments.[82] [83]

Environmental tape [edit]

In 2009, Wells Fargo ranked 1st among banks and insurance companies, and 13th overall, in Newsweek Mag's countdown "Dark-green Rankings" of the state's 500 largest companies.[84]

In 2013, the visitor was recognized past the EPA Center for Corporate Climate Leadership as a Climate Leadership Award winner, in the category "Excellence in Greenhouse Gas Management (Goal Setting Certificate)"; this recognition was for the company'south aim to reduce its absolute greenhouse gas emissions from its U.s.a. operations by 35% by 2020 versus 2008 levels.[85]

In 2017, Wells Fargo ranked 182nd out of 500 in Newsweek Magazine'south "Green Rankings" of the largest US companies;[86]

Newsweek's 2020 listing of "America's Nearly Responsible Companies" did not include Wells Fargo.[87]

Wells Fargo has provided more than than $10 billion in financing for environmentally beneficial business organization opportunities, including supporting commercial-scale solar photovoltaic projects and utility-scale wind projects nationwide.[88]

In 2010, Wells Fargo launched what information technology believes to be the first weblog among its industry peers to report on its environmental stewardship and to solicit feedback and ideas from its stakeholders.[89]

Wells Fargo History Museum [edit]

The visitor operates the Wells Fargo History Museum at 420 Montgomery Street, San Francisco. Displays include original stagecoaches, photographs, gold nuggets and mining artifacts, the Pony Express, telegraph equipment, and celebrated bank artifacts. The museum too has a souvenir store.[90] In January 2015, armed robbers in an SUV smashed through the museum's glass doors and stole gold nuggets.[91] [92] [93] [94] The company previously operated other museums but those take since closed.[95]

Operations and services [edit]

Map of Wells Fargo branches in August 2015

Consumer Cyberbanking and Lending [edit]

The Consumer Banking and Lending segment includes Regional Banking, Diversified Products, and Consumer Deposits groups, likewise every bit Wells Fargo Customer Connection (formerly Wells Fargo Telephone Bank, Wachovia Directly Access, the National Business organization Banking Eye, and Credit Carte Customer Service). Wells Fargo likewise has around 2,000 stand-alone mortgage branches throughout the state. In that location are also mini-branches located inside of other buildings, which are near exclusively grocery stores, that ordinarily contain ATMs, basic bank teller services, and an office for individual meetings with customers.[3]

Consumer lending [edit]

Wells Fargo Home Mortgage is the 2nd largest retail mortgage originator in the United States, originating ane out of every four home loans.[96] Wells Fargo services $1.viii trillion in home mortgages, the one of the largest servicing portfolios in the The states.[iii]

Equipment lending [edit]

Wells Fargo has various divisions, including Wells Fargo Rails, that finance and charter equipment to different types of companies.[three]

Wealth and Investment Direction [edit]

Wells Fargo Advisors headquarters in St. Louis, Missouri

Wells Fargo offers investment products through its subsidiaries, Wells Fargo Investments, LLC, and Wells Fargo Advisors, LLC, likewise as through national broker/dealer firms. The company also serves loftier-cyberspace-worth individuals through its private banking concern and family wealth group.

Wells Fargo Advisors is the brokerage subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the third-largest brokerage firm in the Usa as of the 3rd quarter of 2010 with $1.ane trillion retail customer assets under management.[3]

Wells Fargo Advisors was known every bit Wachovia Securities until May 1, 2009, when it was renamed post-obit Wells Fargo's acquisition of Wachovia Corporation.

Securities [edit]

The Seagram Building: Home of Wells Fargo Securities' New York offices and trading floors

Wells Fargo Securities (WFS) is the investment banking division of Wells Fargo & Co. headquartered in Charlotte, with other U.Due south. offices in New York, Minneapolis, Boston, Houston, San Francisco, and Los Angeles and with international offices in London, Hong Kong, Singapore, and Tokyo.

Wells Fargo Securities was established in 2009 after the conquering of Wachovia Securities. Information technology provides merger and acquisition, high yield, leveraged finance, equity underwriting, individual placement, loan syndication, risk management, and public finance services

Cross-selling [edit]

A central part of Wells Fargo'due south business concern strategy is cantankerous-selling, the practice of encouraging existing customers to buy boosted cyberbanking services.[99] [100] Customers inquiring well-nigh their checking account rest may be pitched mortgage deals and mortgage holders may be pitched credit carte du jour offers in an attempt to increase the client's profitability to the depository financial institution.[101] [102] Other banks have attempted to emulate Wells Fargo'south cantankerous-selling practices (described past The Wall Street Journal as a hard sell technique).[101]

International operations [edit]

Wells Fargo has cyberbanking services throughout the world, with overseas offices in Hong Kong, London, Dubai, Singapore, Tokyo, and Toronto.[103] [104] Back-offices are in India and the Philippines with more than 20,000 staff.[105]

In 2010, hedge fund administrator Citco purchased the trust company operation of Wells Fargo in the Cayman Islands.[106]

Charter [edit]

Wells Fargo operates under Charter #one, the start national bank charter issued in the United states of america. This lease was issued to First National Banking concern of Philadelphia on June 20, 1863, by the Part of the Comptroller of the Currency.[107] Traditionally, acquiring banks assume the earliest issued charter number. Thus, the showtime charter passed from Outset National Bank of Philadelphia to Wells Fargo through its 2008 acquisition of Wachovia, which had inherited it through 1 of its many acquisitions.

Lawsuits, fines and controversies [edit]

1981 MAPS Wells Fargo embezzlement scandal [edit]

In 1981, it was discovered that a Wells Fargo assistant operations officer, Lloyd Benjamin "Ben" Lewis, had perpetrated one of the largest embezzlements in history, through its Beverly Bulldoze co-operative. During 1978 - 1981, Lewis had successfully written phony debit and credit receipts to do good battle promoters Harold J. Smith (né Ross Eugene Fields) and Sam "Sammie" Marshall, chairman and president, respectively, of Muhammed Ali Professional Sports, Inc. (MAPS), of which Lewis was likewise listed as a director; Marshall, too, was a former employee of the same Wells Fargo branch as Lewis. In excess of $300,000 was paid to Lewis, who pled guilty to embezzlement and conspiracy charges in 1981, and testified against his co-conspirators for a reduced five-twelvemonth sentence.[108] (Boxer Muhammed Ali had received a fee for the use of his name, and had no other interest with the system.[109])

Higher costs charged to African-American and Hispanic borrowers [edit]

Illinois Chaser General Lisa Madigan filed suit against Wells Fargo on July 31, 2009, alleging that the banking concern steers African Americans and Hispanics into loftier-cost subprime loans. A Wells Fargo spokesman responded that "The policies, systems, and controls we have in identify – including in Illinois – ensure race is not a gene..."[110] An affidavit filed in the case stated that loan officers had referred to black mortgage-seekers every bit "mud people," and the subprime loans as "ghetto loans."[111] According to Beth Jacobson, a loan officer at Wells Fargo interviewed for a report in The New York Times, "Nosotros just went right afterwards them. Wells Fargo mortgage had an emerging-markets unit that specifically targeted black churches because information technology figured church leaders had a lot of influence and could convince congregants to take out subprime loans." The report presented data from the urban center of Baltimore, where more than half the properties discipline to foreclosure on a Wells Fargo loan from 2005 to 2008 now stand up vacant. And 71 pct of those are in predominantly black neighborhoods.[111] Wells Fargo agreed to pay $125 million to subprime borrowers and $l million in direct down payment help in certain areas, for a full of $175 million.[112] [113] [114]

Failure to monitor suspected money laundering [edit]

In a March 2010 agreement with United states of america federal prosecutors, Wells Fargo best-selling that between 2004 and 2007 Wachovia had failed to monitor and report suspected coin laundering by narcotics traffickers, including the greenbacks used to purchase four planes that shipped a total of 22 tons of cocaine into Mexico.[115]

Overdraft fees [edit]

In Baronial 2010, Wells Fargo was fined by United States commune court judge William Alsup for overdraft practices designed to "gouge" consumers and "profiteer" at their expense, and for misleading consumers about how the bank processed transactions and assessed overdraft fees.[116] [117]

Settlement and fines regarding mortgage servicing practices [edit]

On Feb 9, 2012, information technology was announced that the v largest mortgage servicers (Ally Financial, Bank of America, Citigroup, JPMorgan Chase, and Wells Fargo) agreed to a settlement with the US Federal Government and 49 states.[118] The settlement, known every bit the National Mortgage Settlement (NMS), required the servicers to provide about $26 billion in relief to distressed homeowners and in direct payments to the federal and land governments. This settlement corporeality makes the NMS the 2nd largest civil settlement in U.Southward. history, only trailing the Tobacco Master Settlement Agreement.[119] The 5 banks were besides required to comply with 305 new mortgage servicing standards. Oklahoma held out and agreed to settle with the banks separately.[120]

On April five, 2012, a federal judge ordered Wells Fargo to pay $three.ane 1000000 in castigating damages over a single loan, one of the largest fines for a bank ever for mortgaging service misconduct, afterward the depository financial institution improperly charged Michael Jones, a New Orleans homeowner, with $24,000 in mortgage fees, after the bank misallocated payments to involvement instead of principal. Elizabeth Magner, a federal bankruptcy judge in the Eastern District of Louisiana, cited the bank's beliefs as "highly reprehensible", stating that Wells Fargo has taken advantage of borrowers who rely on the banking company's accurate calculations.[121] [122] The laurels was affirmed on entreatment in 2013.[123]

In May 2013, New York chaser-general Eric Schneiderman announced a lawsuit against Wells Fargo over alleged violations of the national mortgage settlement. Schneidermann claimed Wells Fargo had violated rules over giving fair and timely serving.[124] In 2015, a judge sided with Wells Fargo.[125]

SEC fine due to inadequate hazard disclosures [edit]

On August 14, 2012, Wells Fargo agreed to pay effectually $half dozen.five meg to settle U.S. Securities and Commutation Commission (SEC) charges that in 2007 it sold risky mortgage-backed securities without fully realizing their dangers.[126]

Lawsuit by FHA over loan underwriting [edit]

In 2016, Wells Fargo agreed to pay $ane.two billion to settle allegations that the company violated the Simulated Claims Deed by underwriting over 100,000 Federal Housing Administration (FHA) backed loans when over half of the applicants did non qualify for the programme.[127] [128]

In October 2012, Wells Fargo was sued by U.s. Chaser Preet Bharara over questionable mortgage deals.[129]

[edit]

In April 2013, Wells Fargo settled a suit with 24,000 Florida homeowners aslope insurer QBE Insurance, in which Wells Fargo was defendant of inflating premiums on forced-place insurance.[130]

Lawsuit regarding excessive overdraft fees [edit]

In May 2013, Wells Fargo paid $203 1000000 to settle class-activity litigation accusing the bank of imposing excessive overdraft fees on checking-account customers.[131]

Violation of New York credit card laws [edit]

In February 2015, Wells Fargo agreed to pay $4 1000000, including a $ii million penalty and $2 1000000 in restitution for illegally taking an interest in the homes of borrowers in exchange for opening credit carte accounts for the homeowners.[132]

Tax liability and lobbying [edit]

In December 2011, Public Campaign criticized Wells Fargo for spending $11 million on lobbying during 2008–2010, while increasing executive pay and laying off workers, while having no federal taxation liability due to losses from the Great Recession.[133] However, in 2013, the company paid $9.1 billion in income taxes.[134]

Prison industry investment [edit]

The company has invested its clients' funds in GEO Grouping, a multi-national provider of for-turn a profit private prisons.[135] By March 2012, its pale had grown to more than 4.4 1000000 shares worth $86.7 million.[136] Equally of November 2012, Wells Fargo divested 33% of its holdings of GEO'southward stock, reducing its stake to 4.98% of Geo Group's common stock, below the threshold of which it must disclose farther transactions.[137] [138]

Discrimination against African Americans in hiring [edit]

In August 2020, the company agreed to pay $vii.8 million in back wages for allegedly discriminating against 34,193 African Americans in hiring for tellers, personal bankers, customer sales and service representatives, and administrative back up positions. The company agreed to provide jobs to 580 of the affected applicants.[139]

SEC settlement for insider trading case [edit]

In May 2015, Gregory T. Bolan Jr., a stock analyst at Wells Fargo agreed to pay $75,000 to the U.S. Securities and Exchange Commission to settle allegations that he gave Joseph C. Ruggieri, a stock trader, insider information on likely ratings charges. Ruggieri was non bedevilled of any crime.[140] [141] [142]

Wells Fargo simulated accounts scandal [edit]

In September 2016, Wells Fargo was issued a combined full of $185 meg in fines for opening over one.5 1000000 checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. The Consumer Financial Protection Bureau issued $100 meg in fines, the largest in the bureau's v-twelvemonth history, along with $50 million in fines from the Urban center and County of Los Angeles, and $35 million in fines from the Office of Comptroller of the Currency.[143] The scandal was caused past an incentive-bounty programme for employees to create new accounts. Information technology led to the firing of almost 5,300 employees and $5 one thousand thousand existence fix aside for customer refunds on fees for accounts the customers never wanted.[144] Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.six million in stock, options, and restricted Wells Fargo shares as a retirement package.[145] [146]

On October 12, 2016, John Stumpf, the then chairman and CEO, announced that he would exist retiring amidst the scandals. President and Chief Operating Officer Timothy J. Sloan succeeded Stumpf, effective immediately. Following the scandal, applications for credit cards and checking accounts at the bank plummeted.[147] In response to the event, the Better Business Bureau dropped accreditation of the bank.[148] [149] Several states and cities ended business concern relations with the visitor.[150]

An investigation by the Wells Fargo board of directors, the written report of which was released in April 2017, primarily blamed Stumpf, who it said had not responded to evidence of wrongdoing in the consumer services division, and Tolstedt, who was said to have knowingly set impossible sales goals and refused to respond when subordinates disagreed with them. Wells Fargo coined the phrase, "Get for Gr-Eight" – or, in other words, aim to sell at to the lowest degree 8 products to every customer. The lath chose to use a clawback clause in the retirement contracts of Stumpf and Tolstedt to recover $75 one thousand thousand worth of cash and stock from the former executives.[151]

In Feb 2020, the company agreed to pay $three billion to settle claims by the United States Department of Justice and the Securities and Exchange Commission. The settlement did not prevent individual employees from being targets of futurity litigation.[152] The Federal Reserve put a limit to Wells Fargo'south assets, as a result of the scandal. In 2020, Wells Fargo sold $100 million in assets to stay under the limit.[153]

Racketeering lawsuit for mortgage appraisal overcharges [edit]

In Nov 2016, Wells Fargo agreed to pay $50 million to settle allegations of overcharging hundreds of thousands of homeowners for appraisals ordered afterward they defaulted on their mortgage loans. While banks are allowed to charge homeowners for such appraisals, Wells Fargo frequently charged homeowners $95 to $125 on appraisals for which the bank had been charged $fifty or less. The plaintiffs had sought triple damages under the U.South. Racketeer Influenced and Corrupt Organizations Act on grounds that sending invoices and statements with fraudulently curtained fees constituted postal service and wire fraud sufficient to allege racketeering.[154]

Financing of Dakota Access Pipeline [edit]

Wells Fargo is a lender on the Dakota Access Pipeline, a ane,172-mile-long (1,886 km) underground oil pipeline send system in N Dakota. The pipeline has been controversial regarding its potential impact on the environment.[155]

In Feb 2017, the metropolis councils of Seattle, Washington and Davis, California voted to move $three billion of deposits from the banking company due to its financing of the Dakota Access Pipeline also as the Wells Fargo account fraud scandal.[156]

Failure to comply with certificate security requirements [edit]

In December 2016, the Financial Industry Regulatory Authority fined Wells Fargo $five.5 million for failing to store electronic documents in a "write one time, read many" format, which makes information technology impossible to change or destroy records subsequently they are written.[157]

Doing business with the gun industry and NRA [edit]

From December 2012 through February 2018, Wells Fargo reportedly helped two of the biggest firearms and armament companies obtain $431.one million in loans. It also handled banking for the National Rifle Clan and provided banking company accounts and a $28-1000000 line of credit.[158] In 2020, the visitor said that information technology is winding downwards its concern with the National Burglarize Clan.[159]

Discrimination against female workers [edit]

In June 2018, about a dozen female Wells Fargo executives from the wealth management division met in Scottsdale, Arizona to talk over the minimal presence of women occupying senior roles within the company. The meeting, dubbed "the coming together of 12", represented the majority of the regional managing directors, of which 12 out of 45 were women.[160] Wells Fargo had previously been investigating reports of gender bias in the partitioning in the months leading up to the meeting.[161] The women reported that they had been turned down for top jobs despite their qualifications, and instead the roles were occupied past men.[161] There were besides complaints against company president Jay Welker, who is also the head of the Wells Fargo wealth management sectionalisation, due to his sexist statements regarding female employees. The female workers claimed that he called them "girls" and said that they "should be at home taking care of their children."[161] [162]

Overselling motorcar insurance [edit]

On June 10, 2019, Wells Fargo agreed to pay $385 million to settle a lawsuit accusing information technology of allegedly scamming millions of automobile-loan customers into ownership insurance they did not need from National General Insurance.[163] [164]

Failure to Supervise Registered Representatives [edit]

On August 28, 2020, Wells Fargo agreed to pay a fine of $350,000 also equally $10 one thousand thousand in restitution payments to certain customers after the Financial Industry Regulatory Authority accused the company of failing to reasonably supervise two of its registered representatives that recommended that customers invest a loftier percent of their avails in high-risk free energy securities in 2014 and 2015.[165]

Steering customers to more than expensive retirement accounts [edit]

In April 2018, the United states Department of Labor launched a probe into whether Wells Fargo was pushing its customers into more expensive retirement plans equally well as into retirement funds managed by Wells Fargo itself.[166] [167]

Alteration of documents [edit]

In May 2018, the company discovered that its business banking group had improperly contradistinct documents almost business organisation clients in 2017 and early 2018.[168]

Executive compensation [edit]

With CEO John Stumpf paid 473 times more than than the median employee, Wells Fargo ranked number 33 among the S&P 500 companies for CEO—employee pay inequality. In October 2014, a Wells Fargo employee earning $15 per hour emailed the CEO—copying 200,000 other employees—request that all employees be given a $10,000 per yr enhance taken from a portion of annual corporate profits to address wage stagnation and income inequality. After being contacted by the media, Wells Fargo responded that all employees receive "market competitive" pay and benefits significantly to a higher place US federal minimums.[169] [170]

Pursuant to Department 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Human activity, publicly traded companies are required to disembalm (1) the median total annual compensation of all employees other than the CEO and (2) the ratio of the CEO's annual full compensation to that of the median employee.[171]

Carbon footprint [edit]

Wells Fargo & Company reported Total CO2e emissions (Direct + Indirect) for the twelve months ending 31 Dec 2020 at 776 Kt (-87 /-10.1% y-o-y).[172] There has been a consistent declining trend in reported emissions since 2015.

| Dec 2015 | December 2016 | December 2017 | Dec 2018 | Dec 2019 | December 2020 |

|---|---|---|---|---|---|

| i,185[173] | 1,061[174] | 934[175] | 929[176] | 863[177] | 776[172] |

In popular culture [edit]

Wells Fargo stagecoaches are mentioned in the song "The Deadwood Stage (Whip-Crack-Away!)" in the 1953 moving picture Cataclysm Jane performed by Doris Day: "With a fancy cargo, care of Wells and Fargo, Illinois - Boy!".[178]. Wells Fargo is also shown as the delivery service bringing the instruments for the town band in the 1962 motion picture The Music Man.

Charity [edit]

On March two, 2022, Wells Fargo announced $i mln donation to the American Red Cross that will be used for Ukrainian refugees fleeing from the Russian invasion.[179]

In April 2022, The Wells Fargo foundation appear its pledge of $210 million toward racial equity in homeownership. With $sixty million of the donation awarded in Wealth Opportunities Restored through Homeownership (WORTH) grants which will run until 2025. Additionally, $150 million will be committed to lower mortgage rates and reducing the refinancing costs to aid minority homeowners.[180]

Come across as well [edit]

- List of Wells Fargo directors

- List of Wells Fargo presidents

- Wells Fargo Arena

- Wells Fargo Middle

- Big Iv banks

References [edit]

- ^ Wack, Kevin (Feb 26, 2020). "How New York became Wells Fargo'southward new center of ability". American Banker.

- ^ a b c d eastward "4th quarter earnings 2021" (PDF). Wells Fargo.

- ^ a b c d e f grand h i j "Wells Fargo & Company Almanac Report 2020" (PDF). wellsfargo.com. Wells Fargo.

- ^ Wack, Kevin (February 26, 2020). "How New York became Wells Fargo's new eye of power". American Broker.

- ^ "FRB: Large Commercial Banks".

- ^ Gray, Melinda (February 7, 2014). "Wells Fargo Tops List of World'southward Most Valuable Depository financial institution Brands". Chicago Agent.

- ^ "The Pinnacle 500 Banking Brands, 2014". The Banker. Feb three, 2014.

- ^ "Fortune 500: Wells Fargo". Fortune.

- ^ Flitter, Emily; Appelbaum, Binyamin; Cowley, Stacy (Feb ii, 2018). "Federal Reserve Shackles Wells Fargo Subsequently Fraud Scandal". The New York Times.

- ^ Hugh Son (September 27, 2021). "Wells Fargo pays $37 million to resolve Justice Department claims it defrauded currency customers". CNBC. Retrieved September 27, 2021.

- ^ [1] Accessed March 14, 2022.

- ^ "Butterfield Overland Mail". California State Parks.

- ^ "William George Fargo". Encyclopædia Britannica.

- ^ Engstrand, Iris. "Wells Fargo: California's Pioneer Banking company" (PDF). San Diego History.

- ^ "Enlisting the stagecoach during WWI". Wells Fargo. June 29, 2018.

- ^ "Wells and Fargo start shipping and bank". History.com.

- ^ "A Salute to the Society's Corporate Patrons: Wells Fargo Bank, N.a." Southern California Quarterly. 66 (4): 377–378. 1984. doi:ten.2307/41171130. JSTOR 41171130.

- ^ "Surviving and thriving in the Great Depression". Wells Fargo. March 13, 2019.

- ^ "Wells Fargo, American Trust Merge every bit the 11th Biggest Bank". The New York Times. March 26, 1960.

- ^ Kovner, Guy (February 12, 2015). "Santa Rosa power broker, philanthropist Henry Trione dies at 94". The Press Democrat.

- ^ "Wells Fargo Bank Is Given Holding Company Approving". The New York Times. January 31, 1969.

- ^ Johnson, Patt (August 1, 2017). "Business icon who helped bring Wells Fargo to Des Moines dies at 87". The Des Moines Register.

- ^ MAHONY, EDMUND H. (February 29, 2008). "Not GUILTY PLEA IN 1983 ARMED ROBBERY". Hartford Courant.

- ^ Madden, Richard L. (December 11, 1983). "WELLS FARGO THEFT, three MONTHS LATER: ONLY TANTALIZING LEADS TO $vii One thousand thousand". The New York Times.

- ^ Pollack, Andrew (May 31, 1986). "CROCKER Absorbed INTO WELLS FARGO". The New York Times.

- ^ Gruber, William (February viii, 1986). "WELLS FARGO BUYS CROCKER". Chicago Tribune.

- ^ "Wells Fargo & Visitor 1987 Almanac Report" (PDF).

- ^ Lawrence M. Fisher (January sixteen, 1988). "Wells Fargo to Purchase Barclays in California". The New York Times.

- ^ "Regulators seize Great American Banking concern". United Press International. August 9, 1991.

- ^ "Wow! Two decades of banking online". Wells Fargo. May 18, 2015.

- ^ Hansell, Saul (January 25, 1996). "Wells Fargo Wins Battle for First Interstate". The New York Times.

- ^ Baker, David R. (December 19, 2004). "When hostile takeovers backfire". San Francisco Chronicle.

- ^ Svaldi, Aldo (June 12, 1998). "Wells Fargo learned difficult manner about deals". American City Business Journals.

- ^ "Wells Fargo, Norwest pair". CNN. June viii, 1998.

- ^ O'Brien, Timothy L. (June 9, 1998). "Wells Fargo And Norwest Program Merger". The New York Times.

- ^ "Wells Fargo to Purchase Alaskan Bank". Los Angeles Times. December 22, 1999.

- ^ "H.D. Vest to be acquired past Internet company Blucora for $580 million". Investment News. October fifteen, 2015.

- ^ "Wells Fargo Names Stumpf CEO; Kovacevich Remains Chair". CNBC. Reuters. June 27, 2007.

- ^ "Wells Fargo, Greater Bay Bancorp Agree to Merge" (Press release). PR Newswire. May 4, 2007.

- ^ Said, Carolyn (May 5, 2007). "Wells Fargo buys bank / Greater Bay has 41 branches in the Bay Expanse". San Francisco Chronicle.

- ^ "Wells Fargo Gobbles Up Greater Bay Bancorp". The New York Times. May 7, 2007.

- ^ Barris, Mike (May 4, 2007). "Wells Fargo Agrees to Learn Greater Bay Bancorp for $1.five Billion". The Wall Street Periodical.

- ^ "Wells Fargo to purchase Placer Sierra Bank, owner of iv Bank of Lodi branches". Lodi News-Lookout man. January 9, 2007.

- ^ "Wells Fargo to Purchase CIT Unit". American Banker. June 22, 2007.

- ^ Stempel, Jonathan (June 22, 2007). "Wells Fargo to buy CIT Group'south construction unit". Reuters.

- ^ "Wells to learn United Bancorp of Wyoming". American City Business organisation Journals. January 15, 2008.

- ^ Chad Eric Watt (August 13, 2008). "Wells Fargo to acquire Century Bank". American City Business Journals.

- ^ "Wells Fargo agrees to buy Wachovia; Citi objects". USA Today. Associated Press. Oct 4, 2008.

- ^ "Court tilts Wachovia fight toward Wells". WABC-Idiot box. October 5, 2008.

- ^ "Court tilts Wachovia fight toward Wells Fargo". Times Internet. October 6, 2008.

- ^ "Wells Fargo plans to buy Wachovia; Citi ends talks". USA Today. Associated Press. October ix, 2008.

- ^ "Capital Purchase Program Transaction Report" (PDF). Transactions Report (Troubled Asset Relief Programme). November 17, 2008.

- ^ Landler, Mark & Dash, Eric (October 15, 2008). "Drama Behind a $250 billion Banking Bargain". The New York Times.

- ^ Temple, James (May ix, 2009). "Wells Fargo stock offer raises $8.6 billion". San Francisco Relate.

- ^ Barr, Alistair (December 23, 2009). "Citigroup and Wells Fargo go out TARP". MarketWatch.

- ^ "Wells Fargo buys North Declension Surety Insurance". American Metropolis Business Journals. April 20, 2009.

- ^ Ahmed, Azam (August 15, 2011). "Wells Fargo Brings Citadel'southward Investment Banking Unit Aboard". The New York Times.

- ^ Moyer, Liz; Rieker, Matthias (Baronial 16, 2011). "Wells Fargo Scores Citadel Investment-Bank Talent, Deals". The Wall Street Journal.

- ^ Touryalai, Halah (August 16, 2011). "Don't Read Likewise Much Into Wells Fargo'due south Bargain With Citadel". Forbes.

- ^ "Wells Fargo to Acquire Merlin Securities, LLC" (Press release). Business Wire. Apr 27, 2012.

- ^ "Wells Fargo to Buy Prime Brokerage Firm". The New York Times. Apr 27, 2012.

- ^ "Wells Fargo Rebrands Merlin Securities to Wells Fargo Prime Services" (Press release). Business Wire. December 3, 2012.

- ^ "Wells Fargo Announces the Sale of Its Majority Stake in The Stone Creek Grouping" (Press release). Business Wire. July 5, 2018.

- ^ "Wells Fargo Agrees to Learn GE'south Railcar Leasing Business organization". Bloomberg News. September 30, 2015.

- ^ Koren, James Rufus (October 14, 2015). "Wells Fargo buys 3 GE units focused on equipment financing". Los Angeles Times.

- ^ Dillet, Romain (March 27, 2017). "Wells Fargo will let you lot use Apple Pay and Android Pay to withdraw coin". TechCrunch.

- ^ Levitt, Hannah (June 5, 2018). "Wells Fargo sells all its branches in Indiana, Michigan, Ohio". Bloomberg News.

- ^ Egan, Matt (June 5, 2018). "Wells Fargo sells all its branches in iii Midwestern states". CNN.

- ^ Moise, Imani (June 5, 2018). "Wells Fargo pulls back from U.S. Midwest, selling 52 branches to Flagstar". Reuters.

- ^ "Wells Fargo Plans To Eliminate Upward To 26,450 Jobs Past 2020". HuffPost. Reuters. September 21, 2018.

- ^ Egan, Matt (September xx, 2018). "Wells Fargo plans to cut upwardly to 26,500 jobs over 3 years". CNN.

- ^ LIBERTO, JENNIFER (March 28, 2019). "Wells Fargo CEO Quits In Wake Of Consumer Financial Scandals". NPR.

- ^ "Master Completes Acquisition of Wells Fargo Institutional Retirement & Trust Business organisation" (Press release). Principal Fiscal Grouping. July 1, 2019.

- ^ Egan, Matt (September 27, 2019). "Wells Fargo names financial veteran Charles Scharf as its new CEO". CNN.

- ^ "Wells Fargo Agrees to Sell Private Student Loan Portfolio" (Press release). Business Wire. December 18, 2020.

- ^ Truong, Kevin (December 21, 2020). "Wells Fargo sells off private educatee loan concern". American City Business Journals.

- ^ "TD Banking company Group completes acquisition of Wells Fargo's Canadian Direct Equipment Finance Business" (Printing release). Toronto-Dominion Banking concern. May 3, 2021.

- ^ French, David; Hussain, Noor (February 23, 2021). "Wells Fargo sells nugget management arm to private disinterestedness firms for $2.1 billion". Reuters.

- ^ "Wells Fargo Enters Agreement with GTCR and Reverence Capital Partners to Sell Wells Fargo Nugget Management" (Press release). Wells Fargo. Feb 23, 2021.

- ^ "Wells Fargo sells asset management arm to private-equity firms for $2.one billion". CNBC. Reuters. February 23, 2021.

- ^ Bakery, Sophie; Comtois, James (March 11, 2021). "Wells Fargo unit sale hailed every bit opportunity". Pensions & Investments.

- ^ "Wells Fargo Closed-Finish Funds Denote Modify of Name" (Press release). Business Wire. July 26, 2021.

- ^ Segal, Julie (July 26, 2021). "Wells Fargo Asset Management to Get New CEO and New Brand". Institutional Investor.

- ^ "Newsweek: HP meridian 'green' company". American City Business organization Journals. September 25, 2009.

- ^ "2013 Climate Leadership Award Winners". EPA Center for Corporate Climate Leadership. United States Environmental Protection Agency. March one, 2013.

- ^ "Top Green Companies in the U.S. 2017". Newsweek. December six, 2017. Retrieved September 27, 2021.

- ^ Newsweek (Nov 20, 2019). "America's About Responsible Companies 2020". Newsweek . Retrieved September 27, 2021.

- ^ "Wells Fargo surpasses $10 billion in taxation-equity financing of renewable energy projects". Wells Fargo. February 25, 2021.

- ^ "Wells Fargo launches environmental blog (Charlotte)". American Urban center Business Journals. Apr 7, 2010.

- ^ "Museum - Wells Fargo History". Wells Fargo.

- ^ Calvey, Mark (February xix, 2015). "Wells Fargo History Museum reopens after gold heist". American Urban center Business concern Journals.

- ^ "PHOTOS: Robbery at San Francisco'due south Wells Fargo Museum". KGO-Boob tube. January 29, 2015.

- ^ Glazer, Emily (January 27, 2015). "Gilded Nuggets Stolen From Wells Fargo Museum in San Francisco". The Wall Street Journals.

- ^ CORKERY, MICHAEL (January 27, 2015). "Robbers Crash Into Wells Fargo Museum to Steal Gold Nuggets". The New York Times.

- ^ Hudson, Caroline (September two, 2020). "Wells Fargo to permanently shutter nearly all of its museums". American City Business organization Journals.

- ^ Fox, Zach; Dupe, Zuhaib (July 16, 2020). "Quicken overtakes Wells Fargo every bit nation'south No. 1 mortgage originator". S&P Global.

- ^ O'Daniel, Adam (November 1, 2012). "Wells Fargo to open new Charlotte trading flooring in Knuckles Energy Center". American City Business organization Journals.

- ^ "PHOTOS: First look at Wells Fargo Securities' new trading flooring". American City Business Journals. Nov 29, 2012.

- ^ Tayan, Brian (Dec 19, 2016). "The Wells Fargo Cross-Selling Scandal". Harvard Constabulary School.

- ^ Egan, Matt (Jan 13, 2017). "Wells Fargo dumps toxic 'cross-selling' metric". CNN.

- ^ a b Smith, Randall (February 28, 2011). "In Tribute to Wells, Banks Effort the Hard Sell". The Wall Street Journal.

- ^ Touryalai, Halah (January 25, 2012). "The Art Of The Cross-Sell". Forbes.

- ^ "International Locations and Contacts – Wells Fargo Commercial".

- ^ Glazer, Emily (Apr thirteen, 2015). "A Wait at Wells Fargo's Overseas Expansion".

- ^ "Why United states of america banking giant Wells Fargo is creating back-office jobs in India". Firstpost. June 22, 2012.

- ^ Pfeuti, Elizabeth (November 23, 2010). "Fund administration giant buys Cayman rival; Asset managers are returning to the offshore domicile afterward retreating in the aftermath of the Crunch". Financial News.

- ^ Riggs, Charles (July 6, 2009). "Wells Fargo'south Charter Number (cont'd)". Wells Fargo.

- ^ Miller, Wilbur R.The Social History of Crime and Punishment in America: An Encyclopedia, SAGE Publications, 2012, page 666. Retrieved September eleven, 2018.

- ^ Anderson, Dave (Feb one, 1981). "Sports of The Times; The Maps Boxing Scandal". The New York Times.

- ^ "Illinois Files Bias Suit Against Wells Fargo". Reuters. July 31, 2009.

- ^ a b Powell, Michael (June vii, 2009). "Bank Defendant of Pushing Mortgage Deals on Blacks". The New York Times.

- ^ Broadwater, Luke (July 13, 2012). "Wells Fargo agrees to pay $175M settlement in pricing discrimination conform". The Baltimore Sun.

- ^ Yost, Pete (July 13, 2012). "Wells Fargo settles bigotry case". Associated Printing.

- ^ "Justice Department Reaches Settlement with Wells Fargo Resulting in More Than $175 1000000 in Relief for Homeowners to Resolve Off-white Lending Claims" (Press release). U.s.a. Section of Justice. July 12, 2012.

- ^ Smith, Michael (June 29, 2010). "Banks Financing Mexico Gangs Admitted in Wells Fargo Deal". Bloomberg News.

- ^ Gelles, Jeff (August 15, 2010). "Consumer ten.0: How Wells Fargo held up debit-card customers". The Philadelphia Inquirer.

- ^ "Wells Fargo loses consumer instance over overdraft fees". Los Angeles Times. Bloomberg News. August 10, 2010.

- ^ "Joint State-Federal Mortgage Servicing Settlement FAQ". National Mortgage Settlement.

- ^ Schwartz, Nelson D.; Creswell, Julie (Feb x, 2012). "Mortgage Program Gives Billions to Homeowners, but With Exceptions". The New York Times.

- ^ "Did Oklahoma A.G. Scott Pruitt, Mortgage Settlement Holdout, Sell Out His State for Wall Street?". February ix, 2012.

- ^ Hallman, Ben (September 4, 2012). "Wells Fargo Slapped With $3.1 Meg Fine For 'Reprehensible' Handling Of One Mortgage". HuffPost.

- ^ GAROFALO, PAT (April 10, 2012). "Gauge Blasts Wells Fargo's 'Reprehensible' Actions, Awards Homeowner $3 One thousand thousand". ThinkProgress.

- ^ "Jones v. Wells Fargo Domicile Mortg., Inc". March xix, 2013.

- ^ Isidore, Chris (October ii, 2013). "Wells Fargo charged with violating mortgage bargain". CNN.

- ^ Viswanatha, Aruna; Freifeld, Karen (February two, 2015). "Judge rules for Wells Fargo in NY challenge over mortgage settlement". Reuters.

- ^ Blumenthal, Jeff (August 14, 2012). "Wells Fargo paying $6.5M to settle charges with SEC". American City Business Journals.

- ^ "Wells Fargo Depository financial institution Agrees to Pay $1.2 Billion for Improper Mortgage Lending Practices" (Press release). U.s. Department of Justice. April 8, 2016.

- ^ Raice, Shayndi (October 10, 2012). "U.Due south. Sues Wells Fargo for Faulty Mortgages". The Wall Street Journal.

- ^ "U.Southward. Accuses Banking company of America of a 'Brazen' Mortgage Fraud". The New York Times. October 24, 2012.

- ^ "Wells Fargo, QBE Concord on $nineteen.3M Forcefulness-Placed Settlement". Property Prey 360. May 17, 2013.

- ^ Stempel, Jonathan (May 15, 2013). "Wells Fargo ordered to pay $203 meg in overdraft case". Reuters.

- ^ Freifeld, Karen (February 5, 2015). "Wells Fargo to pay $4 million for violations on credit carte du jour accounts: New York". Reuters.

- ^ Portero, Ashley. "30 Major U.Due south. Corporations Paid More to Lobby Congress Than Income Taxes, 2008–2010". International Concern Times. Archived from the original on January 7, 2012.

- ^ McIntyre, Douglas (March 17, 2013). "Companies paying the almost in income taxes". USA Today.

- ^ Dolan, Eric W. (November x, 2011). "Wells Fargo takes estrus over investments in private prison manufacture". The Raw Story. Archived from the original on Oct sixteen, 2012.

The advocacy group Minor Business United on Th called on Wells Fargo to provide a total bookkeeping of investments related to private prisons and immigrant detention centers.

- ^ Greenwald, Glenn (Apr 12, 2012). "Wells Fargo's prison house cash cow". Salon.com.

The bailed-out depository financial institution has used its taxpayer money to invest in individual prisons.

- ^ "CORRECTION: Wells Fargo Dumps 33% of Geo Group Stock". pcasc. October 25, 2012.

- ^ "CORRECTION: WELLS FARGO PRIVATE Prison DIVESTMENT". Prison Industry Divestment Motility. November 2, 2012.

- ^ "WELLS FARGO AGREES TO PAY $seven.8 MILLION IN Back WAGES AFTER U.South. Department OF LABOR ALLEGES HIRING Bigotry". The states Section of Labor. August 24, 2020.

- ^ Armental, Maria (September 14, 2015). "Insider-Trading Charges Confronting Erstwhile Wells Fargo Trader Dismissed". The Wall Street Journal.

- ^ Raymond, Nate (September xiv, 2015). "Update: two-Ex-Wells Fargo trader beats SEC insider trading charges". Reuters.

- ^ "Ex-Wells Fargo Analyst Settles Insider Trading Case". Law360. May 28, 2015.

- ^ "Wells Fargo fined $185M for fake accounts; 5,300 were fired". The states Today. September 8, 2016.

- ^ Glazer, Emily (September 9, 2016). "Wells Fargo Fined for Sales Scam". The Wall Street Journal. ISSN 0099-9660.

- ^ Gandel, Stephen (September 12, 2016). "Wells Fargo Exec Who Headed Phony Accounts Unit Collected $125 Million". Fortune.

- ^ Corkery, Michael (September 20, 2016). "Illegal Activity at Wells Fargo May Have Begun Earlier, Chief Says". The New York Times . Retrieved September 20, 2016.

- ^ Roberts, Deon. "Wells Fargo reveals latest mail service-scandal customer traffic numbers". Charlotte Observer.

- ^ Cox, Jeff (October 20, 2016). "Wells Fargo just lost its accreditation with the Better Business Bureau". CNBC.

- ^ Procter, Richard (October 12, 2016). "Wells Fargo loses Better Business Bureau accreditation, which could accept years to regain". American Urban center Business Journals.

- ^ "Massachusetts latest to bar Wells Fargo every bit underwriter". Reuters. Oct 18, 2016.

- ^ Cowley, Stacy; Kingson, Jennifer A. (Apr 10, 2017). "Wells Fargo to Claw Dorsum $75 Million From ii Former Executives". The New York Times.

- ^ Egon, Matt (February 22, 2020). "The states government fines Wells Fargo $3 billion for its 'staggering' imitation-accounts scandal". CNN.

- ^ Steinberg, Julie; Eisen, Ben (July 31, 2020). "Wells Fargo Sold Avails to Stay Under Fed Nugget Cap as Markets Lurched". The Wall Street Journal.

- ^ Aubin, Dena (October 31, 2016). "Wells Fargo agrees to $50 million settlement over homeowner fees". Reuters.

- ^ Fuller, Emily (September 29, 2016). "How to Contact the 17 Banks Funding the Dakota Admission Pipeline". YES! Magazine.

- ^ Chappell, Bill (February 8, 2017). "2 Cities To Pull More Than $3 Billion From Wells Fargo Over Dakota Access Pipeline".

- ^ "FINRA fines Wells Fargo, others $14 mln for records' changeable format". Reuters. December 21, 2016.

- ^ "Wells Fargo is the height banker for the NRA and gunmakers". Los Angeles Times. Bloomberg News. March 7, 2018.

- ^ Moise, Imani (April 28, 2020). "Wells Fargo'due south relationship with NRA is 'failing': CEO". Reuters.

- ^ Glazer, Emily (August 31, 2018). "At Wells Fargo, Discontent Simmers Among Female person Executives". The Wall Street Journal. ISSN 0099-9660.

- ^ a b c Rooney, Kate (Baronial 31, 2018). "Wells Fargo said to be investigating reports of gender bias in its wealth division". CNBC.

- ^ Glazer, Emily (August 31, 2018). "At Wells Fargo, Discontent Simmers Among Female person Executives". The Wall Street Journal.

- ^ Hudson, Caroline (June 10, 2019). "Wells Fargo agrees to $385M settlement for auto insurance scheme". American Urban center Business Journals.

- ^ Dugan, Kevin (June 7, 2019). "Wells Fargo to pay at least $385 million to settle scam allegations". New York Post.

- ^ "FINANCIAL INDUSTRY REGULATORY Authorisation Letter OF Credence, WAIVER AND CONSENT NO. 2015045713304" (PDF). August 28, 2021.

- ^ Morgenson, Gretchen; Glazer, Emily (April 26, 2018). "Wells Fargo's 401(yard) Practices Probed past Labor Department". The Wall Street Journal.

- ^ Rooney, Kate (April 26, 2018). "Labor Section is reportedly investigating Wells Fargo'southward 401(k) unit". CNBC.

- ^ Egan, Matt (May 17, 2018). "Wells Fargo altered documents about business organisation clients". CNN.

- ^ Short, Kevin (October 9, 2014). "Wells Fargo Employee Calls Out CEO's Pay, Requests Company-Wide Raise In Dauntless Email". HuffPost.

- ^ Schafer, Leo (October 15, 2014). "Schafer: Wells Fargo missed mark afterwards worker requested $x,000 raises for all". Star Tribune.

- ^ "H.R.4173 - Dodd-Frank Wall Street Reform and Consumer Protection Act". Congress.gov.

- ^ a b "Wells Fargo's ESG Datasheet for 2020Q4" (PDF). Archived from the original (PDF) on October v, 2021. Alt URL

- ^ "Wells Fargo's ESG Datasheet for 2017Q4" (PDF). Archived from the original (PDF) on November 4, 2021. Alt URL

- ^ "Wells Fargo's ESG Datasheet for 2018Q4" (PDF). Archived from the original (PDF) on November 4, 2021. Alt URL

- ^ "Wells Fargo's ESG Datasheet for 2019Q4" (PDF). Archived from the original (PDF) on September 17, 2020. Alt URL

- ^ "Wells Fargo'due south ESG Datasheet for 2020Q4" (PDF). Archived from the original (PDF) on October five, 2021. Alt URL

- ^ "Wells Fargo's ESG Datasheet for 2020Q4" (PDF). Archived from the original (PDF) on October 5, 2021. Alt URL

- ^ "Deadwood Stage (Whip Crack Away, Calamity Jane) Lyrics". lyricsfreak.com.

- ^ Amiah Taylor (March vii, 2022). "Google transforms Poland office into help center for Ukrainian refugees". Fortune. Retrieved March 8, 2022.

- ^ "Wells Fargo commits $210 million toward racial disinterestedness in homeownership". Philanthropy News Digest. April fifteen, 2022. Retrieved May 4, 2022.

{{cite web}}: CS1 maint: url-condition (link)

External links [edit]

- Official website

- Business data for Wells Fargo & Co:

- Google Finance

- Yahoo! Finance

- Bloomberg

- Reuters

- SEC filings

Source: https://en.wikipedia.org/wiki/Wells_Fargo

0 Response to "Jennifer Sloan Wells Fargo Center for the Arts Bankruptcy"

Post a Comment